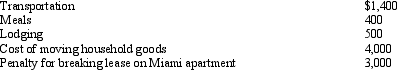

Due to a merger,Allison transfers from Miami to Chicago.Under a new job description,she is reclassified from employee to independent contractor status.Her moving expenses,which are not reimbursed,are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Q87: Carolyn is single and has a college

Q91: Ralph made the following business gifts during

Q94: Bill is employed as an auditor by

Q103: The § 222 deduction for tuition and

Q107: Which of the following expenses, if any,

Q110: Elaine, the regional sales director for a

Q112: Which, if any, of the following expenses

Q116: Which, if any, of the following expenses

Q119: Which, if any, of the following is

Q127: During 2012, Eva used her car as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents