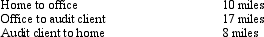

Bill is employed as an auditor by a CPA firm.On most days,he commutes by auto from his home to the office.During one month,however,he has an extensive audit assignment closer to home.For this engagement,Bill drives directly from home to the client's premises and back.Mileage information is summarized below:

If Bill spends 21 days on the audit,what is his deductible mileage?

If Bill spends 21 days on the audit,what is his deductible mileage?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Carolyn is single and has a college

Q91: Ralph made the following business gifts during

Q93: Due to a merger,Allison transfers from Miami

Q106: In contrasting the reporting procedures of employees

Q107: Which of the following expenses, if any,

Q110: Elaine, the regional sales director for a

Q112: Which, if any, of the following expenses

Q116: Which, if any, of the following expenses

Q119: Which, if any, of the following is

Q127: During 2012, Eva used her car as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents