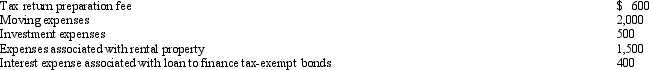

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Q81: If a vacation home is determined to

Q82: Which of the following is relevant in

Q83: In January, Lance sold stock with a

Q90: Which of the following must be capitalized

Q92: Bob and April own a house at

Q94: Which of the following is not a

Q95: Arnold and Beth file a joint return.Use

Q97: Which of the following is not deductible?

A)Moving

Q98: Priscella pursued a hobby of making bedspreads

Q101: Sandra sold 500 shares of Wren Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents