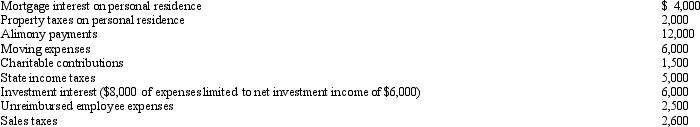

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: If a vacation home is determined to

Q82: Which of the following is relevant in

Q83: In January, Lance sold stock with a

Q90: Which of the following must be capitalized

Q92: Bob and April own a house at

Q94: Which of the following is not a

Q96: Cory incurred and paid the following expenses:

Q97: Which of the following is not deductible?

A)Moving

Q98: Priscella pursued a hobby of making bedspreads

Q100: Robin and Jeff own an unincorporated hardware

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents