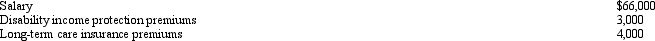

James,a cash basis taxpayer,received the following compensation and fringe benefits in 2012:  His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

A) $66,000.

B) $72,000.

C) $73,000.

D) $75,000.

E) None of the above.

Correct Answer:

Verified

Q62: A company has a medical reimbursement plan

Q66: Kristen's employer owns its building and provides

Q73: A U.S.citizen worked in a foreign country

Q75: Heather is a full-time employee of the

Q76: Evaluate the following statements: Q80: Tommy, a senior at State College, receives Q80: Under the Swan Company's cafeteria plan,all full-time Q81: George,an unmarried cash basis taxpayer,received the following Q91: Hazel, a solvent individual but a recovering Q95: Beverly died during the current year. At![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents