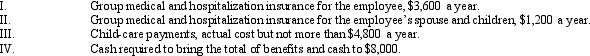

Under the Swan Company's cafeteria plan,all full-time employees are allowed to select any combination of the benefits below,but the total received by the employee cannot exceed $8,000 a year.  Which of the following statements is true?

Which of the following statements is true?

A) Sam, a full-time employee, selects choices II and III and $2,000 cash. His gross income must include the $2,000.

B) Paul, a full-time employee, elects to receive $8,000 cash because his wife's employer provided these same insurance benefits for him. Paul is not required to include the $8,000 in gross income.

C) Sue, a full-time employee, elects to receive choices I, II and $3,200 for III. Sue is required to include $3,200 in gross income.

D) All of the above.

E) None of the above.

Correct Answer:

Verified

Q62: A company has a medical reimbursement plan

Q73: A U.S.citizen worked in a foreign country

Q76: Evaluate the following statements: Q78: James,a cash basis taxpayer,received the following compensation Q80: Tommy, a senior at State College, receives Q81: George,an unmarried cash basis taxpayer,received the following Q84: Doug and Pattie received the following interest Q85: Heather's interest and gains on investments for Q91: Hazel, a solvent individual but a recovering Q95: Beverly died during the current year. At![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents