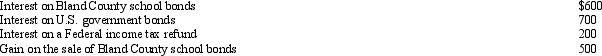

Heather's interest and gains on investments for 2012 were as follows:  Heather's gross income from the above is:

Heather's gross income from the above is:

A) $2,000.

B) $1,800.

C) $1,400.

D) $1,300.

E) None of the above.

Correct Answer:

Verified

Q80: Under the Swan Company's cafeteria plan,all full-time

Q81: George,an unmarried cash basis taxpayer,received the following

Q81: Martha participated in a qualified tuition program

Q83: Louise works in a foreign branch of

Q84: Doug and Pattie received the following interest

Q85: Gold Company was experiencing financial difficulties, but

Q88: In December 2012, Todd, a cash basis

Q91: Hazel, a solvent individual but a recovering

Q95: Beverly died during the current year. At

Q100: On January 1, 2002, Cardinal Corporation issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents