Snipe Corporation,a calendar year taxpayer,has total E & P of $800,000.During the current year,Snipe makes property distributions to Tracy (the sole shareholder) as follows:  As a result of these distributions:

As a result of these distributions:

A) Snipe Corporation must recognize a gain of $30,000 and no recognized loss.

B) Snipe Corporation must recognize a gain of $30,000 and recognize a loss of $10,000.

C) Snipe Corporation recognizes neither gain nor loss.

D) Tracy will have a basis of $100,000 in the stock investment and $270,000 in the land.

E) None of the above.

Correct Answer:

Verified

Q109: Which of the following statements, if any,

Q110: Laurie is a 70% shareholder in Martin

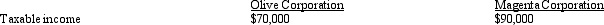

Q111: In converting a corporation's taxable income for

Q112: Camilla and Dean form Grouse Corporation with

Q114: As of January 1,2012,Amanda,the sole shareholder of

Q116: Which, if any, of the following transactions

Q116: As of January 1,2012,Owl Corporation (a calendar

Q117: Pete contributes land (basis of $80,000; fair

Q118: Shrike Corporation is liquidated and its assets

Q120: In determining a partner's basis in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents