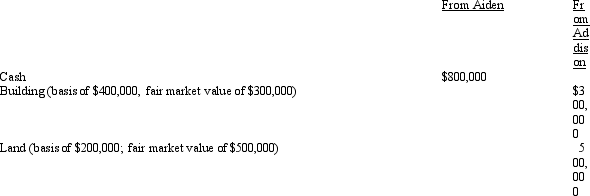

Shrike Corporation is liquidated and its assets are distributed to its 10 equal and unrelated individual shareholders.The assets distributed are as follows:  One of the tax consequences of the liquidating distribution is:

One of the tax consequences of the liquidating distribution is:

A) No gain or loss is recognized by Shrike Corporation.

B) Shrike Corporation will recognize no loss on the securities, but must recognize a gain of $100,000 on the land.

C) The shareholders will have a basis of $1,000,000 in the property they receive.

D) The shareholders will have a basis of $1,100,000 in the property they receive.

E) None of the above.

Correct Answer:

Verified

Q113: Snipe Corporation,a calendar year taxpayer,has total E

Q114: As of January 1,2012,Amanda,the sole shareholder of

Q116: As of January 1,2012,Owl Corporation (a calendar

Q117: Pete contributes land (basis of $80,000; fair

Q119: Hailey redeems some of the stock she

Q120: In determining a partner's basis in the

Q120: As of January 1,2012,Donald,the sole shareholder of

Q121: Crimson Corporation owns stock in other C

Q122: Sophia contributes land to the Tan Partnership

Q123: Scarlet Company,a clothing retailer,donates children's clothing to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents