Azure Corporation,a calendar year taxpayer,has taxable income of $850,000 for the current year.Among the transactions that related to Azure during the year are the following:

Convert Azure's taxable income to current E & P.

Convert Azure's taxable income to current E & P.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: In December 2012,Oriole Company's board authorizes a

Q126: During 2012,a calendar year taxpayer had the

Q127: Four unrelated,calendar year corporations are formed on

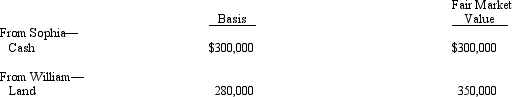

Q128: Arthur forms Catbird Corporation with the following

Q130: Rowena is the sole shareholder of Rail,a

Q131: Why were the check-the-box Regulations issued?

Q131: For 2011,Plover Corporation,a calendar year taxpayer,had net

Q132: Cerulean Corporation owns 6% of the stock

Q133: Spencer owns 50% of the stock of

Q134: Regarding the check-the-box Regulations,comment on each of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents