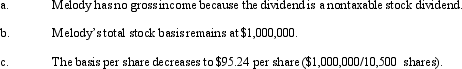

Inez's adjusted basis for 9,000 shares of Cardinal,Inc.common stock is $900,000.During the year,she receives a 5% stock dividend that is a nontaxable stock dividend.

Correct Answer:

Verified

Q4: Robert sold his ranch which was his

Q11: Annette purchased stock on March 1, 2012,

Q19: Bill is considering two options for selling

Q88: Nigel purchased a blending machine for $125,000

Q106: Felix gives 100 shares of stock to

Q107: Renee purchases taxable bonds with a face

Q110: Ollie owns a personal use car for

Q113: Marge purchases the Kentwood Krackers,a AAA level

Q114: Faith inherits an undivided interest in a

Q159: The basis of personal use property converted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents