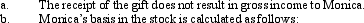

Felix gives 100 shares of stock to his daughter,Monica.The stock was acquired in 2003 for $20,000,and at the time of the gift,it had a fair market value of $60,000.Felix paid a gift tax of $6,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Annette purchased stock on March 1, 2012,

Q101: Peggy uses a delivery van in her

Q101: Emma gives her personal use automobile (cost

Q102: Elbert gives stock worth $28,000 (no gift

Q103: Hubert purchases Fran's jewelry store for $950,000.The

Q107: Renee purchases taxable bonds with a face

Q110: Ollie owns a personal use car for

Q111: Inez's adjusted basis for 9,000 shares of

Q141: Lynn purchases a house for $52,000. She

Q159: The basis of personal use property converted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents