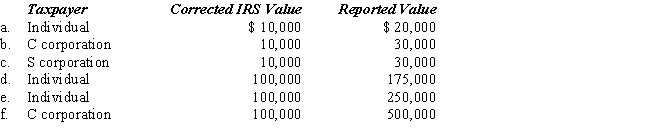

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal Federal income tax rate of 35%.

Correct Answer:

Verified

Q111: The Treasury document regulating the professional conduct

Q130: The tax preparer penalty for taking an

Q131: Silvio, a cash basis, calendar year taxpayer,

Q136: Compute the failure to pay and failure

Q139: A(n) _ member is required to follow

Q142: Yin-Li is the preparer of the Form

Q160: What are the chief responsibilities of the

Q166: Evaluate this statement: a taxpayer is liable

Q166: Specific factors that are used in selecting

Q168: Describe the potential outcomes to a party

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents