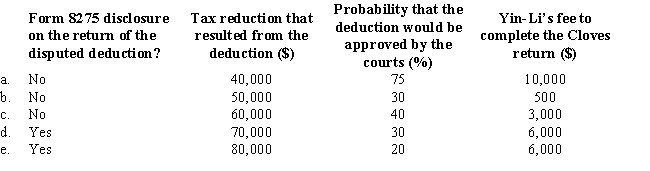

Yin-Li is the preparer of the Form 1120 for Cloves Corporation.On the return,Cloves claimed a deduction that the IRS later disallowed on audit.Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q130: The tax preparer penalty for taking an

Q131: Silvio, a cash basis, calendar year taxpayer,

Q139: A(n) _ member is required to follow

Q140: Compute the overvaluation penalty for each of

Q146: Loren Ltd.,a calendar year taxpayer,had the following

Q160: What are the chief responsibilities of the

Q164: In connection with the taxpayer penalty for

Q166: Evaluate this statement: a taxpayer is liable

Q166: Specific factors that are used in selecting

Q168: Describe the potential outcomes to a party

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents