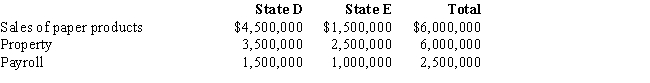

Milt Corporation owns and operates two facilities that manufacture paper products.One of the facilities is located in State D,and the other is located in State E.Milt generated $1,200,000 of taxable income,comprised of $1,000,000 of income from its manufacturing facilities and a $200,000 gain from the sale of nonbusiness property located in E.E does not distinguish between business and nonbusiness property.D apportions business income.Milt's activities within the two states are outlined below.

Both D and E utilize a three-factor apportionment formula,under which sales,property,and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Pail Corporation is a merchandiser.It purchases overstock

Q145: Dott Corporation generated $300,000 of state taxable

Q146: Condor Corporation generated $450,000 of state taxable

Q147: Troy,an S corporation,is subject to tax only

Q160: An ad valorem property tax is based

Q170: Provide the required information for Orange Corporation,

Q173: What is the significance of the term

Q176: Anders, a local business, wants your help

Q181: Franz Corporation is based in State A

Q200: Discuss how a multistate business divides up

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents