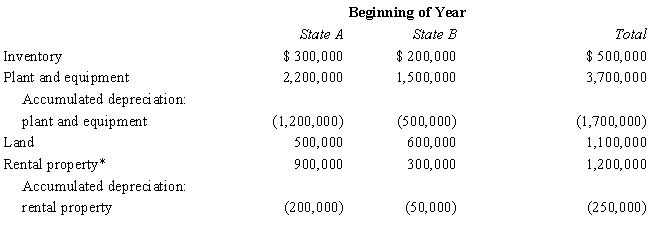

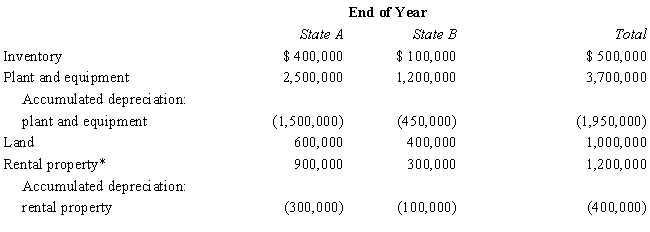

Kim Corporation,a calendar year taxpayer,has manufacturing facilities in States A and B.A summary of Kim's property holdings follows.

*Unrelated to Kim's regular business and operations.

Determine Kim's property factors for the two states.A's statutes provide that the average historical cost of business property is to be included in the property factor.B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q151: Determine Drieser's sales factors for States K,M,and

Q154: Hambone Corporation is subject to the State

Q156: Flip Corporation operates in two states,as indicated

Q157: Mercy Corporation,headquartered in State F,sells wireless computer

Q164: Compost Corporation has finished its computation of

Q172: In international taxation, we discuss income sourcing

Q181: Franz Corporation is based in State A

Q189: State Q wants to increase its income

Q191: Your supervisor has shifted your responsibilities from

Q200: Discuss how a multistate business divides up

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents