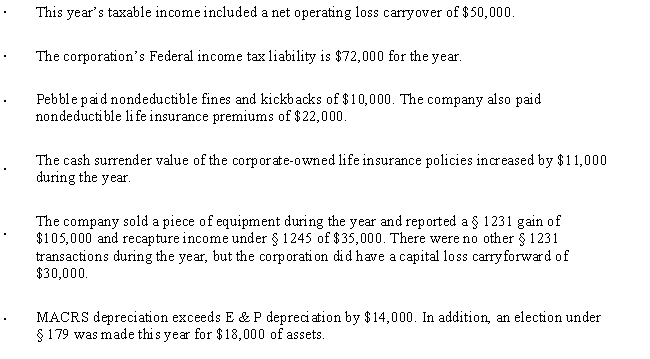

Pebble Corporation,an accrual basis taxpayer,has struggled to survive since its formation,six years ago.As a result,it has a deficit in accumulated E & P at the beginning of the year of $340,000.This year,however,Pebble earned a significant profit; taxable income was $240,000.Consequently,Pebble made two cash distributions to Martha,its sole shareholder: $150,000 on July 1 and $200,000 December 31.The following information might be relevant to determining the tax treatment of the distributions.

a.Compute Pebble's E & P for the year.

b.What are the tax consequences of the two distributions made during the year to Martha (her stock basis is $74,000)?

Correct Answer:

Verified

Q40: The stock of Tan Corporation (E &

Q111: Thistle Corporation declares a nontaxable dividend payable

Q126: Using the legend provided, classify each statement

Q134: Using the legend provided, classify each statement

Q146: Lena is the sole shareholder and president

Q152: Ashley, the sole shareholder of Hawk Corporation,

Q155: Kite Corporation,a calendar year taxpayer,has taxable income

Q160: Albatross Corporation acquired land for investment purposes

Q162: The stock in Crimson Corporation is owned

Q163: Tanya is in the 33% tax bracket.She

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents