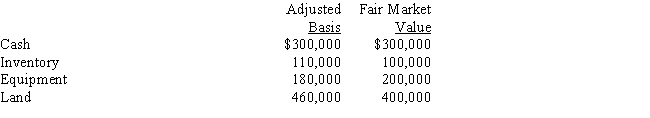

The stock in Crimson Corporation is owned by Angel and Melawi,who are unrelated.Angel owns 60% and Melawi owns 40% of the stock.All of Crimson Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Crimson Corporation:

a.What gain or loss, if any, would Crimson Corporation recognize if it distributes the cash, inventory, and equipment to Angel and the land to Melawi?

b.What gain or loss, if any, would Crimson Corporation recognize if it distributes the equipment and land to Angel and the cash and inventory to Melawi?

Correct Answer:

Verified

Q40: The stock of Tan Corporation (E &

Q126: Using the legend provided, classify each statement

Q142: At the beginning of the current year,

Q146: Lena is the sole shareholder and president

Q158: Pebble Corporation,an accrual basis taxpayer,has struggled to

Q160: Albatross Corporation acquired land for investment purposes

Q163: Tanya is in the 33% tax bracket.She

Q170: Briefly describe the reason a corporation might

Q171: Ivory Corporation (E & P of $1

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents