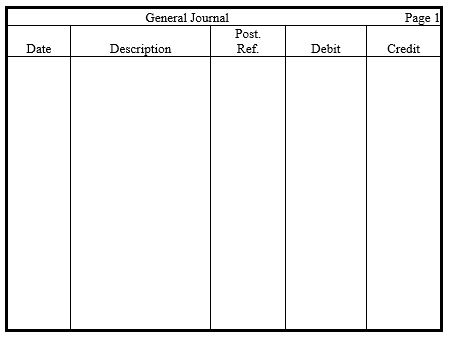

In the journal provided,prepare adjusting entries for the following items.Omit explanations.

a. Unrecorded interest on savings bonds is $680.

b. Property taxes incurred but not paid or recorded amount to $540.

c. Legal fees of $5,000 were collected in advance. By year end, 80 percent were still unearned.

d. Prepaid Insurance had a $1,600 debit balance prior to adjustment. By year end, 25 percent was still unexpired.

e. Salaries incurred by year end but not yet paid or recorded amounted to $1,375.

f. Services totaling $900 have been performed but not yet recorded or billed.

Correct Answer:

Verified

Q141: Which two broad account categories are used

Q148: How and why is the matching rule

Q203: What broad purposes are accomplished by closing

Q212: Dowling Company had supplies on hand costing

Q214: Antonio's Pizza has a delivery truck

Q217: Quality Heating Company has the following

Q219: An examination of the Prepaid Insurance account

Q220: Erwin Press pays wages of $6,000 every

Q222: Susan Kane won the mayoral election in

Q223: Use the following unadjusted trial balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents