Use the following unadjusted trial balance to prepare adjusting entries,given the additional information below it.Assume financial statements are prepared quarterly.Omit explanations.

a. Of the revenue received in advance, 60 percent remained unearned on September 30.

b. The office furniture has an estimated five-year useful life and zero value at the end of that time. Record depreciation for the quarter.

c. Salaries earned, but unpaid, totaled $1,520.

d. The Prepaid Rent applies to the six months beginning July 1, 2010.

e. Office supplies on hand totaled $300 at the end of the quarter.

f. Services performed but not yet billed or recorded amount to $1,800.

Correct Answer:

Verified

Q148: Why will the Income Summary account never

Q203: What broad purposes are accomplished by closing

Q209: Distinguish between adjusting and closing entries.

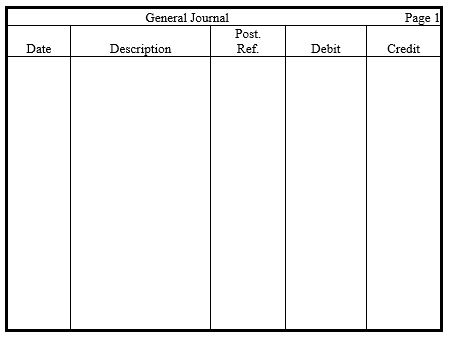

Q218: In the journal provided,prepare adjusting entries for

Q219: An examination of the Prepaid Insurance account

Q220: Erwin Press pays wages of $6,000 every

Q222: Susan Kane won the mayoral election in

Q224: The following amounts are taken from

Q225: In the journal provided,prepare year-end adjustments for

Q228: The Retained Earnings,Dividends,and Income Summary accounts for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents