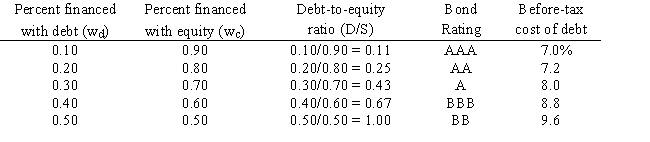

LeCompte Learning Solutions is considering making a change to its capital structure in hopes of increasing its value. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: The company uses the CAPM to estimate its cost of common equity, rs. The risk-free rate is 5% and the market risk premium is 6%. LeCompte estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is LeCompte's optimal capital structure, and what is the firm's cost of capital at this optimal capital structure?

A) wc = 0.9; wd = 0.1; WACC = 14.96%

B) wc = 0.8; wd = 0.2; WACC = 10.96%

C) wc = 0.7; wd = 0.3; WACC = 7.83%

D) wc = 0.6; wd = 0.4; WACC = 10.15%

E) wc = 0.5; wd = 0.5; WACC = 10.18%

Correct Answer:

Verified

Q54: An all-equity firm with 200,000 shares outstanding,Antwerther

Q55: Cartwright Communications is considering making a change

Q63: Pennewell Publishing Inc. (PP) is a zero

Q69: The Anson Jackson Court Company (AJC) currently

Q71: VanMannen Foundations, Inc. (VF)

VanMannen Foundations, Inc. (VF)

Q75: Pennewell Publishing Inc. (PP) is a zero

Q77: VanMannen Foundations, Inc. (VF) is a zero-growth

Q79: Best Bagels, Inc. (BB) currently has zero

Q94: Which of the following statements is CORRECT?

A)

Q97: Anson Jackson Court Company (AJC)

The Anson Jackson

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents