VanMannen Foundations, Inc. (VF)

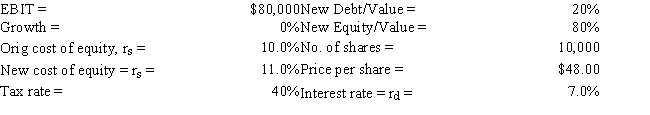

VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

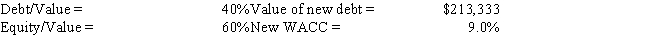

-Refer to the data for VanMannen Foundations, Inc. (VF) . Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $50.67

B) $53.33

C) $56.00

D) $58.80

E) $61.74

Correct Answer:

Verified

Q54: An all-equity firm with 200,000 shares outstanding,Antwerther

Q63: Pennewell Publishing Inc. (PP) is a zero

Q69: The Anson Jackson Court Company (AJC) currently

Q70: LeCompte Learning Solutions is considering making a

Q73: The Anson Jackson Court Company (AJC) currently

Q75: Pennewell Publishing Inc. (PP) is a zero

Q77: VanMannen Foundations, Inc. (VF) is a zero-growth

Q79: Best Bagels, Inc. (BB) currently has zero

Q94: Which of the following statements is CORRECT?

A)

Q97: Anson Jackson Court Company (AJC)

The Anson Jackson

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents