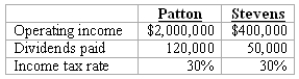

REFERENCE: Ref.07_18  Patton's operating income excludes income from the investment in Stevens,but includes $150,000 of unrealized gains on intercompany transfers of inventory.Patton uses the initial value method to account for the investment in Stevens.

Patton's operating income excludes income from the investment in Stevens,but includes $150,000 of unrealized gains on intercompany transfers of inventory.Patton uses the initial value method to account for the investment in Stevens.

-Assume Patton owns 90 percent of the voting stock of Stevens and files a consolidated income tax return.What amount of income taxes would be paid?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Dotes, Inc. owns 40% of Abner Co.

Q104: How much will the consolidated group save

Q106: On January 1,2009,Youder Inc.bought 120,000 shares of

Q107: REFERENCE: Ref.07_17

On January 1,2009,Maurice Co.acquired 75% of

Q108: REFERENCE: Ref.07_17

On January 1,2009,Maurice Co.acquired 75% of

Q108: For each of the following situations, select

Q108: Jull Corp. owned 80% of Solaver Co.

Q110: REFERENCE: Ref.07_17

On January 1,2009,Maurice Co.acquired 75% of

Q113: REFERENCE: Ref.07_18 Q116: Kurton Inc. owned 90% of Luvyn Corp.'s![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents