REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

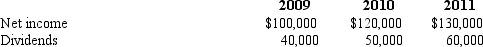

The following data are available pertaining to Wilson's income and dividends:

-Compute the gain on transfer of equipment reported by Simon for 2009.

A) $19,500.

B) $18,250.

C) $11,750.

D) $38,250.

E) $37,500.

Correct Answer:

Verified

Q44: REFERENCE: Ref.05_08

On January 1,2009,Smeder Company,an 80% owned

Q45: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q46: Compute consolidated cost of goods sold.

A) $7,500,000.

B)

Q47: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q48: Which of the following statements is true

Q50: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q51: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q52: REFERENCE: Ref.05_05

Gargiulo Company,a 90% owned subsidiary of

Q53: REFERENCE: Ref.05_05

Gargiulo Company,a 90% owned subsidiary of

Q54: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents