REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

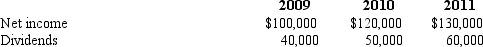

The following data are available pertaining to Wilson's income and dividends:

-Compute the amortization of gain for 2010 for consolidation purposes.

A) $1,950.

B) $1,825.

C) $2,000.

D) $1,500.

E) $7,000.

Correct Answer:

Verified

Q46: Compute consolidated cost of goods sold.

A) $7,500,000.

B)

Q47: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q48: Which of the following statements is true

Q49: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q50: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q52: REFERENCE: Ref.05_05

Gargiulo Company,a 90% owned subsidiary of

Q53: REFERENCE: Ref.05_05

Gargiulo Company,a 90% owned subsidiary of

Q54: REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90%

Q56: REFERENCE: Ref.05_05

Gargiulo Company,a 90% owned subsidiary of

Q72: Assume the same information, except Shannon sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents