REFERENCE: Ref.13_08

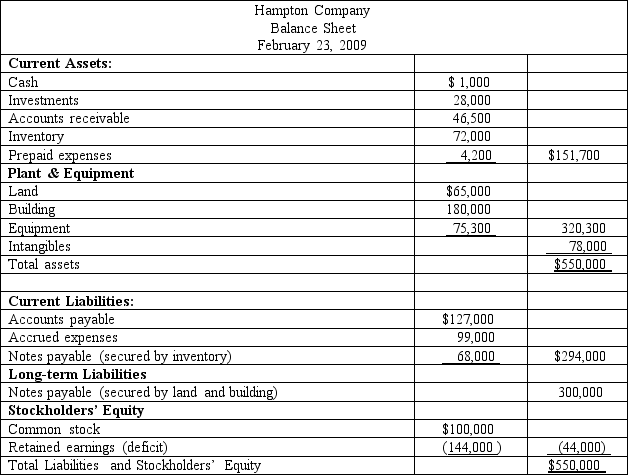

Hampton Company is trying to decide whether to seek liquidation or reorganization.Hampton has provided the following balance sheet:

Additional information is as follows:

Additional information is as follows:

- The investments are currently worth $13,000.

- It is estimated that $32,000 of the accounts receivable are collectible.

- The inventory can be sold for $74,000.

- The prepaid expenses and the intangible assets have no net realizable value.

- The land and building are currently valued at $250,000.

- The equipment can be sold for $60,000.

- Administrative expenses (not yet recorded)are estimated to be $12,500.

- Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

- Accrued expenses include $7,000 of unpaid payroll taxes.

-Compute the amount of free assets after payment of liabilities with priority.

Correct Answer:

Verified

Q50: A company that was to be

Q69: Hampton Company is trying to decide whether

Q71: Free assets after payment of liabilities with

Q71: Mount Inc. was a hardware store that

Q71: Prepare a Statement of Financial Affairs.

Q71: Free assets after payment of liabilities with

Q75: What is the payout percentage to unsecured

Q77: Bazley Co. had severe financial difficulties

Q77: Bazley Co. had severe financial difficulties

Q78: REFERENCE: Ref.13_06

Lucky Co.had cash of $65,000,inventory worth

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents