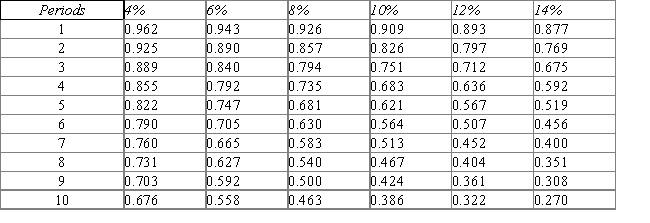

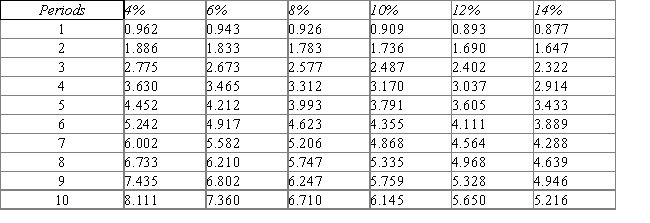

Present value of $1  Present value of an Annuity of $1

Present value of an Annuity of $1

Morgan Clinical Practice is considering an investment in new imaging equipment that will cost $400,000.The equipment is expected to yield cash inflows of $80,000 per year for a six year period.Morgan set a required rate of return at 10%.

- What is the net present value of Project 2?

A) $5,670

B) $20,000

C) $2,530

D) $24,070

E) $4,070

Correct Answer:

Verified

Q109: The following information pertains to an investment:

Q110: A firm is considering a project requiring

Q111: Present value of $1 Q112: Which of the following is true regarding Q113: Amatra Inc., has the opportunity to invest Q115: Elizabeth Myers invested in a project that Q116: Diamond Company is considering the purchase of Q117: Which of the following defines internal rate Q118: Present value of $1 Q119: Cooper Industries is considering a project that![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents