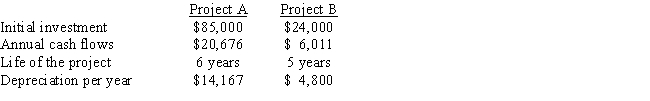

Kenner Company is considering two projects.

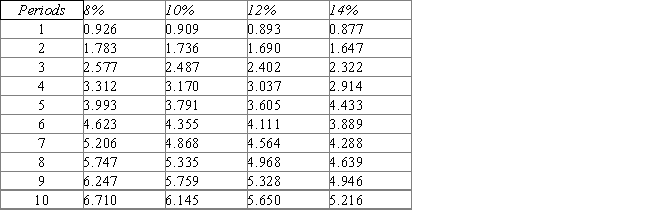

Present value of an Annuity of $1 in Arrears

Present value of an Annuity of $1 in Arrears

- Suppose that Kenner Company requires a minimum rate of return of 8%.Which project is better in terms of net present value?

A) project A with NPV of $10,585

B) project B with NPV of $7,756

C) project A with NPV of $4,210

D) project B with NPV of $1,212

E) both projects have the same NPV

Correct Answer:

Verified

Q130: The _ method of capital investment decision

Q131: A division manager is choosing between two

Q132: Which of the following refers to a

Q133: How do NPV and IRR differ?

A) NPV

Q134: The reason that a discount factor in

Q136: Which of the following is true regarding

Q137: Which of the following is a disadvantage

Q138: Which of the following members of a

Q139: When investing in automated systems, which of

Q140: Present value of an Annuity of $1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents