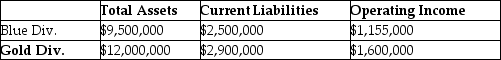

Stonex Corp,whose tax rate is 35%,has two sources of funds: long-term debt with a market value of $6,200,000 and an interest rate of 9%,and equity capital with a market value of $14,000,000 and a cost of equity of 13%.Stonex has two operating divisions,the Blue division and the Gold division,with the following financial measures for the current year:

Calculate EVA for the Gold Division.(Round intermediary calculations to four decimal places. )

A) -$56,290

B) $56,290

C) $1,040,000

D) $983,710

Correct Answer:

Verified

Q37: The top management at Groundsource Company,a manufacturer

Q38: Aeralia Inc. ,has two regional offices.The

Q39: The Cybertronics Corporation reported the following

Q40: The top management at Amore Corp,a manufacturer

Q41: Coldbrook Company has two sources of funds:

Q44: Waldorf Company has two sources of funds:

Q46: Springfield Corporation,whose tax rate is 30%,has two

Q47: Care Inc. ,has two divisions that operate

Q52: Which of the following is a performance

Q56: A company has operating income of $300,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents