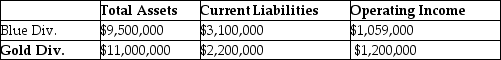

Springfield Corporation,whose tax rate is 30%,has two sources of funds: long-term debt with a market value of $8,400,000 and an interest rate of 8%,and equity capital with a market value of $14,000,000 and a cost of equity of 13%.Springfield has two operating divisions,the Blue division and the Gold division,with the following financial measures for the current year:

What is Economic Value Added (EVA®) for the Blue Division? (Round intermediary calculations to four decimal places. )

A) -$86,580

B) $86,580

C) $404,280

D) -$230,550

Correct Answer:

Verified

Q41: Coldbrook Company has two sources of funds:

Q42: Stonex Corp,whose tax rate is 35%,has two

Q44: Waldorf Company has two sources of funds:

Q44: Times Corporation, whose tax rate is 30%,

Q46: A company which favors the residual income

Q47: Care Inc. ,has two divisions that operate

Q48: Coldbrook Company has two sources of funds:

Q48: Which of the following is the required

Q52: Which of the following is a performance

Q56: A company has operating income of $300,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents