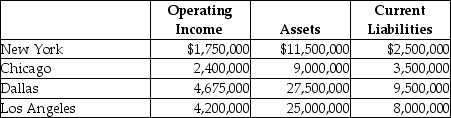

Coptermagic Company supplies helicopters to corporate clients.Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%,and equity capital that has a market value of $18 million (book value of $8 million).The cost of equity capital for Coptermagic is 15%,and its tax rate is 30%.Coptermagic has profit centers in four divisions that operate autonomously.The company's results for 2015 are as follows:

Required:

a.Compute Coptermagic's weighted average cost of capital.

b.Compute each division's Economic Value Added.

c.Rank the divisions by EVA.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: An important element in designing accounting-based performance

Q82: Carriage Incorporated manufactures horse carriages.The company has

Q82: The proponents of using net book value

Q83: Batman Abstract Company has three divisions that

Q84: Home Decor Inc. ,manufactures home cleaning products.The

Q86: Bob's Cellular Phone Company uses ROI to

Q87: Home Decor Inc. ,manufactures home cleaning products.The

Q89: Carriage Incorporated manufactures horse carriages.The company has

Q89: Using net book value as an investment

Q91: Craylon Corp has three divisions,which operate autonomously.Their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents