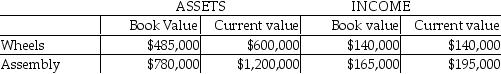

Carriage Incorporated manufactures horse carriages.The company has two divisions,Wheels and Assembly.Because of different accounting methods and inflation rates,the company is considering multiple evaluation measures.The following information is provided for 2018:

The company is currently using a 12% required rate of return.

What are Wheels's and Assembly's residual incomes based on book values,respectively?

A) $71,400;$81,800

B) $81,800;$71,400

C) $68,000;$51,000

D) $51,000;$68,000

Correct Answer:

Verified

Q82: The proponents of using net book value

Q84: Home Decor Inc. ,manufactures home cleaning products.The

Q86: Coptermagic Company supplies helicopters to corporate clients.Coptermagic

Q86: Bob's Cellular Phone Company uses ROI to

Q87: Home Decor Inc. ,manufactures home cleaning products.The

Q89: Using net book value as an investment

Q91: Craylon Corp has three divisions,which operate autonomously.Their

Q92: Which of the following is the formula

Q93: Carriage Incorporated manufactures horse carriages.The company has

Q99: Total assets employed includes all assets, regardless

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents