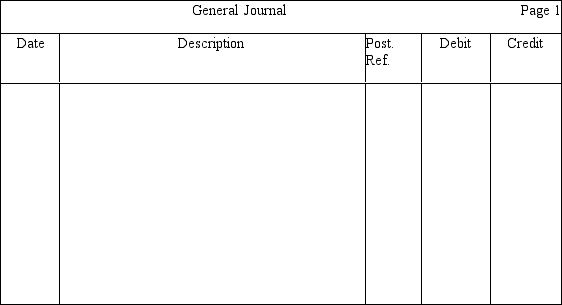

A, B, and C are partners who share profits and losses in a ratio of 3:1:2, respectively. C's Capital account has a $50,000 balance. A and B have agreed to let C take $62,000 of the company's cash when she retires. Prepare an entry in journal form without explanation to record C's exit, including the recognition of a bonus to C.

Correct Answer:

Verified

Q105: In a liquidation,the liabilities of the partnership

Q106: Total partners' equity will not change when

Q111: Tim and Vito are about to liquidate

Q113: X, Y, and Z are partners who

Q114: Beth and Carla form a partnership and

Q118: When a partner withdraws from a partnership

Q118: Jeb and Kelly divide partnership income and

Q120: Avery and Bert are partners who share

Q121: Bjorn and Canute are partners who

Q139: Warren and Spencer are partners in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents