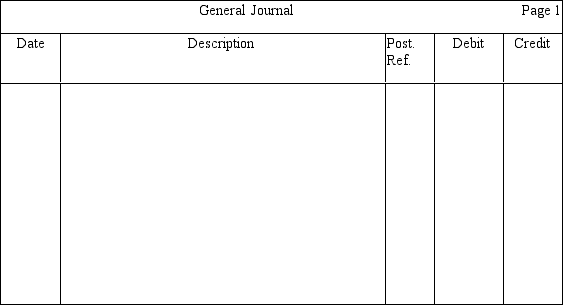

X, Y, and Z are partners who share profits and losses in a ratio of 1:2:3, respectively. Z's Capital account has a $60,000 balance. X and Y have agreed to let Z take $78,000 of the company's cash when he retires. Prepare an entry in journal form without explanation to record Z's exit, including the recognition of a bonus to Z

Correct Answer:

Verified

Q105: In a liquidation,the liabilities of the partnership

Q106: Total partners' equity will not change when

Q109: Sid and Sally divide partnership income and

Q110: A liquidation differs from a dissolution is

Q111: Tim and Vito are about to liquidate

Q114: Beth and Carla form a partnership and

Q115: In a partnership liquidation,

A)creditors should be paid

Q116: A, B, and C are partners who

Q118: When a partner withdraws from a partnership

Q118: Jeb and Kelly divide partnership income and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents