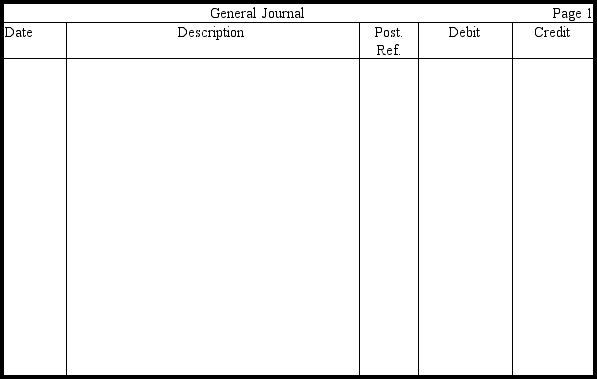

On November 1, 2009, Fields Corporation issued $800,000 worth of ten-year, 9 percent bonds. The semiannual interest dates are November 1 and May 1. Because the market interest rate of similar investments was 8.5 percent, the bonds were issued at a price of 103. Ignoring year-end accruals, prepare entries in journal form without explanations to record the bond issue on November 1, 2009, and the payments of interest and amortization of premium on May 1 and November 1, 2009. Use the effective interest method of amortization. Round answers to the nearest dollar.

Correct Answer:

Verified

Q162: Alby Corporation purchased a warehouse by signing

Q164: On January 1, 2009, Woodvale Corporation issued

Q166: Fiona Corporation has a 7 percent, $600,000

Q169: Boris Corporation had income before income taxes

Q170: On January 1, 2010, Lurline Corporation issued

Q172: West Valley Corporation issues $800,000 of 20-year,9

Q172: On July 1, 2010, Aloha Corporation issued

Q184: When fixed mortgage payments are made,in what

Q189: When a bond sells at a premium,what

Q194: When a bond sells at a discount,what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents