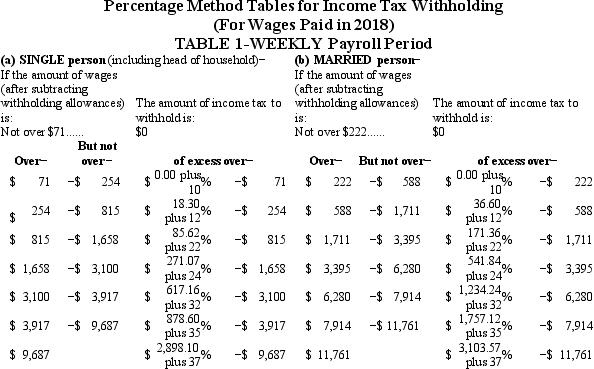

Olga earned $1,558.00 during the most recent weekly pay period.She is single with 2 withholding allowances and no pre-tax deductions.Using the percentage method,compute Olga's federal income tax for the period.(Do not round intermediate calculations.Round final answer to 2 decimal places. )

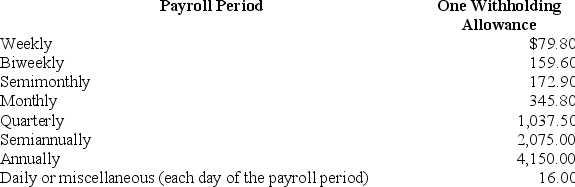

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A) $217.93

B) $239.25

C) $213.97

D) $214.75

Correct Answer:

Verified

Q27: Andie earned $680.20 during the most recent

Q28: Caroljane earned $1,120 during the most recent

Q29: Garnishments may include deductions from employee wages

Q30: Renee is a salaried exempt employee who

Q31: Adam is a part-time employee who earned

Q33: Melody is a full-time employee in Sioux

Q34: Ramani earned $1,698.50 during the most recent

Q35: Julian is a part-time nonexempt employee in

Q36: Paolo is a part-time security guard for

Q37: Natalia is a full-time exempt employee who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents