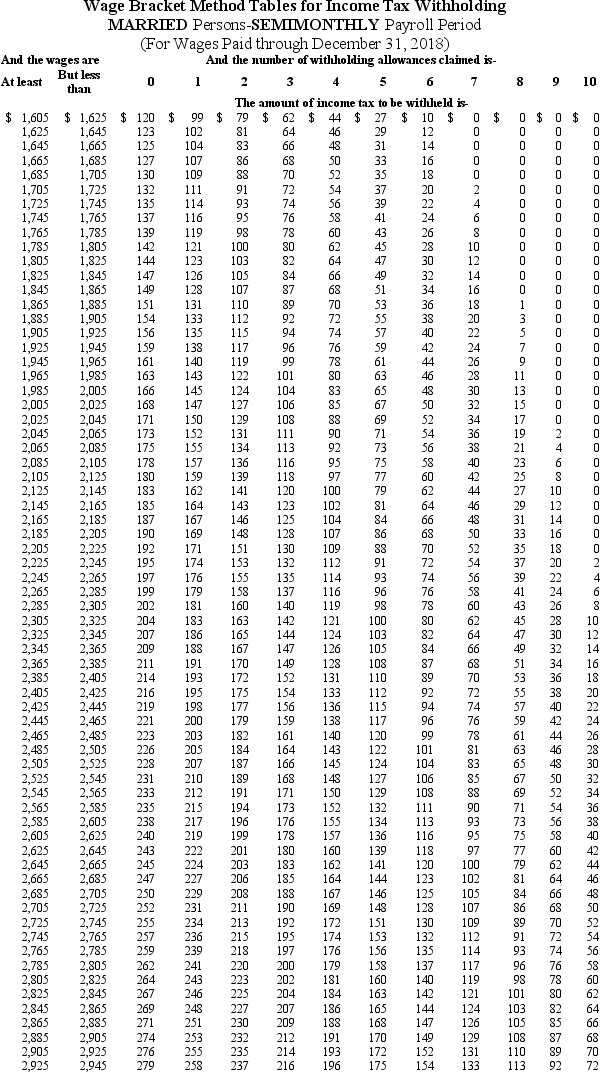

Melody is a full-time employee in Sioux City,South Dakota,who earns $3,600 per month and is paid semimonthly.She is married with 1 withholding allowance (use the wage-bracket tables) .She has a qualified health insurance deduction of $50 per pay period and contributes 3% to her 401(k) ,both of which are pre-tax deductions.What is her net pay? (Round your intermediate calculations and final answer to 2 decimal places. )

A) $1,696.00

B) $1,524.27

C) $1,453.12

D) $1,394.87

Correct Answer:

Verified

Q28: Caroljane earned $1,120 during the most recent

Q29: Garnishments may include deductions from employee wages

Q30: Renee is a salaried exempt employee who

Q31: Adam is a part-time employee who earned

Q32: Olga earned $1,558.00 during the most recent

Q34: Ramani earned $1,698.50 during the most recent

Q35: Julian is a part-time nonexempt employee in

Q36: Paolo is a part-time security guard for

Q37: Natalia is a full-time exempt employee who

Q38: Julio is single with 1 withholding allowance.He

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents