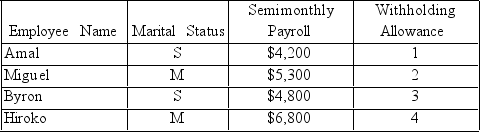

Maeda Company has the following employees on the payroll:

Using the information above,calculate the payroll taxes FICA,federal withholding)for each employee for one payroll period.Assume that Maeda Company receives the maximum credit for state unemployment contributions.Use the percentage method for calculating FIT.Round your answer to 2 decimal places.)

Using the information above,calculate the payroll taxes FICA,federal withholding)for each employee for one payroll period.Assume that Maeda Company receives the maximum credit for state unemployment contributions.Use the percentage method for calculating FIT.Round your answer to 2 decimal places.)

Correct Answer:

Verified

Q107: Sandy is a self-employed health information coder.She

Q108: Jan hired Mike to dog sit for

Q109: GTW Inc.,did not make timely deposits for

Q110: An employer must send Copy A of

Q111: A taxpayer had AGI of $300,000 in

Q113: Maeda Company has the following employees on

Q114: K.Kruse Designs has the following employees:

Q115: Kim works part-time for Medical Assistants Inc.,and

Q116: Griffith & Associates is trying to determine

Q117: A taxpayer with an AGI of $300,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents