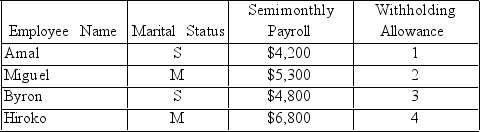

Maeda Company has the following employees on the payroll:

Using the information above:

Using the information above:

a.Calculate the FUTA tax liability for 2016.Assume that Maeda Company has paid all amounts due during the year.

b.If the payroll is consistent from quarter to quarter,how much would be remitted in FUTA taxes in each of the four quarters in 2016?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: Jan hired Mike to dog sit for

Q109: GTW Inc.,did not make timely deposits for

Q110: An employer must send Copy A of

Q111: A taxpayer had AGI of $300,000 in

Q112: Maeda Company has the following employees on

Q114: K.Kruse Designs has the following employees:

Q115: Kim works part-time for Medical Assistants Inc.,and

Q116: Griffith & Associates is trying to determine

Q117: A taxpayer with an AGI of $300,000

Q118: Kathy received a commission of $12,000 from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents