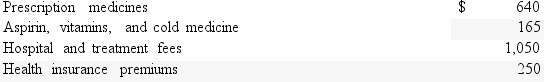

During 2016,Carlos paid the following expenses:  What is the total amount of medical expenses before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2016 income tax return?

What is the total amount of medical expenses before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Carlos's 2016 income tax return?

A) $2,105.

B) $0.

C) $1,885.

D) $1,940.

Correct Answer:

Verified

Q80: Ignacio and Perla are married and both

Q81: How is the medical expense deduction calculated?

Q81: During 2016,Manuel and Gloria,who are married,incurred acquisition

Q82: Which of the deductions listed below is

Q83: Which of the following items would be

Q86: For 2016,the AGI threshold for the deductibility

Q87: Shirin resides in a state that imposes

Q88: Which of the following types of taxes

Q89: For the year ended December 31,2016,Sheniqua,a single

Q90: Donald and May husband and wife)contributed $15,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents