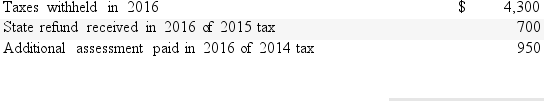

Shirin resides in a state that imposes a tax on income.The following information relates to Shirin's state income tax situation for 2016:  Assuming she elects to deduct state and local income taxes,what amount should Shirin use to calculate itemized deductions for her 2016 federal income tax return?

Assuming she elects to deduct state and local income taxes,what amount should Shirin use to calculate itemized deductions for her 2016 federal income tax return?

A) $5,250.

B) $5,950.

C) $3,600.

D) $0.

Correct Answer:

Verified

Q81: How is the medical expense deduction calculated?

Q82: Which of the deductions listed below is

Q83: Which of the following items would be

Q85: During 2016,Carlos paid the following expenses:

Q86: For 2016,the AGI threshold for the deductibility

Q88: Which of the following types of taxes

Q89: For the year ended December 31,2016,Sheniqua,a single

Q90: Donald and May husband and wife)contributed $15,000

Q91: To qualify for a medical expense deduction

Q92: What is the maximum amount of home

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents