The following data have been gathered for a capital investment decision.

Cash inflows:

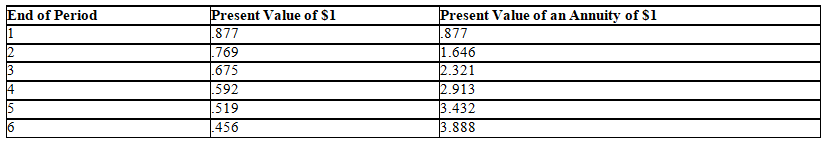

The minimum rate of return for this investment is 14 percent.The present value factors for a 14 percent discount rate are as follows:

a.Compute the present value of each of the cash inflows of the investment.

b.What would have been the present value of the cash flows if they were received in equal installments over the five-year period at the same discount rate? (Assume the total cash inflows remain same. )

c.If the answers to parts (a)and (b)differ,explain the reason(s)why.

Correct Answer:

Verified

b.$240,000

$48...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Memphis Co.is considering purchasing a machine for

Q79: Lopez Co.is interested in purchasing equipment that

Q81: Conducting a preliminary screening of capital investment

Q82: You are given the following present value

Q84: Management of the Krausse Savings and Loan

Q85: The supervisor of a facility has $500,000

Q86: What criteria must be met before accepting

Q87: Fresno Manufacturing Company specializes in the production

Q88: In what situations is the payback period

Q134: Discounting calculates the _ value of an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents