Fresno Manufacturing Company specializes in the production of precision tools.Management is in the process of selecting a new drill press.The press under consideration will cost $92,000 plus necessary installation charges of $5,000.Experience indicates that the press will last for five years and should have a residual value at the end of that period of $10,000.Expected annual cash revenues from the press should average $45,000,and related cash operating costs are estimated to be $20,000.Management has decided on a minimum desired before-tax rate of return of 10 percent.

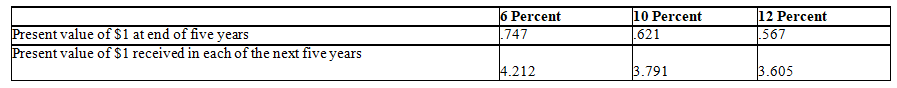

Present value multipliers:

a.Using before-tax information and the net present value method to evaluate this capital investment,determine whether the company should purchase the drill press.Support your answer.

b.If management has decided on a minimum desired before-tax rate of return of 12 percent,should the drill press be purchased? Show all computations to support your answer.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: You are given the following present value

Q83: The following data have been gathered for

Q84: Management of the Krausse Savings and Loan

Q85: The supervisor of a facility has $500,000

Q86: What criteria must be met before accepting

Q88: In what situations is the payback period

Q89: The following data have been gathered for

Q90: Preparing reports related to the capital investment

Q91: You are given the following present value

Q92: Conducting post completion audits to determine if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents