Jordan,Kyle,and Noah Have Equities in a Partnership of $100,000,$160,000,and $140,000,respectively,and

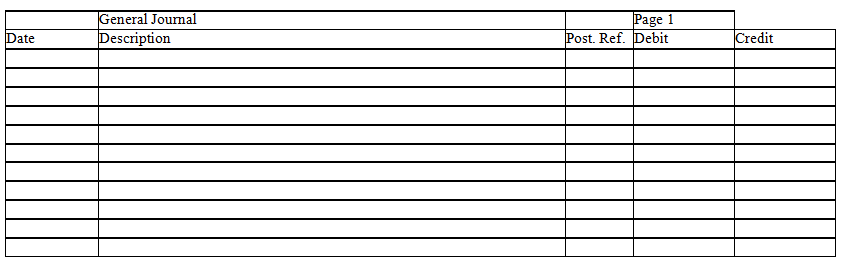

Jordan,Kyle,and Noah have equities in a partnership of $100,000,$160,000,and $140,000,respectively,and share income and losses in a ratio of 5:3:2,respectively.The partners have agreed to admit Billy to the partnership.Prepare entries in journal form without explanations to record the admission of Billy to the partnership under each of the following assumptions:

a.Billy invests $80,000 for a 25 percent interest,and a bonus is recorded for Billy.

b.Billy invests $160,000 for a one-fifth interest,and a bonus is recorded for the old partners.

Correct Answer:

Verified

Q140: Eddie and Lauren are partners in a

Q141: Anne,Barb,and Cathy are partners who share profits

Q142: Paul,Quinn,and Ralph have equities in a partnership

Q143: Chelsea,Harold,and Ryan are liquidating their business.They share

Q144: Elise,Farrah,and Gina are liquidating their business.They share

Q146: Connie and Marcos are partners who share

Q147: Elliot and Jessica are about to liquidate

Q148: Leah,Cameron,and Ryan each receive a $20,000 salary,as

Q149: On December 31,20x5,the X&Y Partnership had the

Q150: X,Y,and Z are partners who share profits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents