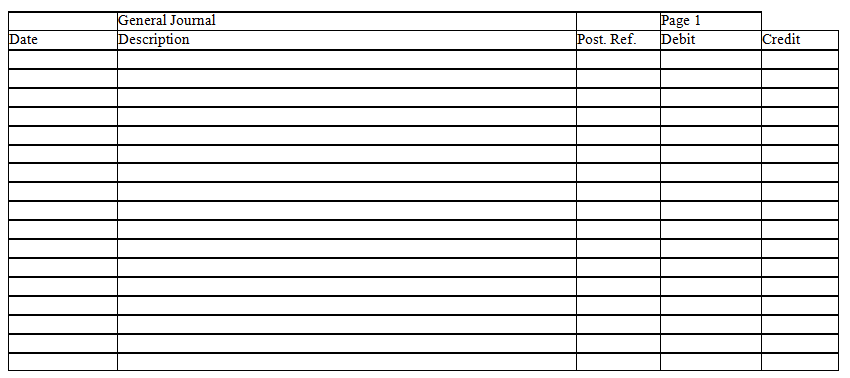

Elliot and Jessica are about to liquidate their partnership.They each have $40,000 capital balances,and they share income and losses in a 3:1 ratio,respectively.In addition,the partnership has $50,000 in cash,$90,000 in noncash assets,and $60,000 in accounts payable.Assuming that the noncash assets are sold for $34,000 and that both partners are personally solvent,prepare all the liquidation entries in the journal provided.

Correct Answer:

Verified

Q142: Paul,Quinn,and Ralph have equities in a partnership

Q143: Chelsea,Harold,and Ryan are liquidating their business.They share

Q144: Elise,Farrah,and Gina are liquidating their business.They share

Q145: Jordan,Kyle,and Noah have equities in a partnership

Q146: Connie and Marcos are partners who share

Q148: Leah,Cameron,and Ryan each receive a $20,000 salary,as

Q149: On December 31,20x5,the X&Y Partnership had the

Q150: X,Y,and Z are partners who share profits

Q151: Jacob and Megan are partners who share

Q152: On December 31,20x5,the R & J Partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents