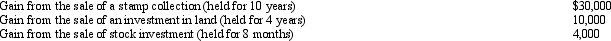

Perry is in the 33% tax bracket.During 2010,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

A) (15% * $10,000) + (28% * $30,000) + (33% * $4,000) .

B) (15% * $30,000) + (33% * $4,000) .

C) (0% * $10,000) + (28% * $30,000) + (33% * $4,000) .

D) (15% * $40,000) + (33% * $4,000) .

E) None of the above.

Correct Answer:

Verified

Q87: Emma had the following transactions during 2010:

Q88: In which,if any,of the following situations will

Q89: The Hutters filed a joint return for

Q90: For the current year,David has salary income

Q91: Which of the following taxpayers may file

Q93: Kyle,whose wife died in December 2007,filed a

Q94: A qualifying child cannot include:

A)A nonresident alien.

B)A

Q95: Ellen,age 12,lives in the same household with

Q96: Millie,age 80,is supported during the current year

Q97: Robert had the following transactions for 2010:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents