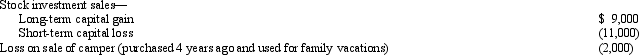

For the current year,David has salary income of $80,000 and the following property transactions:  What is David's AGI for the current year?

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of the above.

Correct Answer:

Verified

Q85: Kirby is in the 15% tax bracket

Q86: Karen had the following transactions for 2010:

Q87: Emma had the following transactions during 2010:

Q88: In which,if any,of the following situations will

Q89: The Hutters filed a joint return for

Q91: Which of the following taxpayers may file

Q92: Perry is in the 33% tax bracket.During

Q93: Kyle,whose wife died in December 2007,filed a

Q94: A qualifying child cannot include:

A)A nonresident alien.

B)A

Q95: Ellen,age 12,lives in the same household with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents