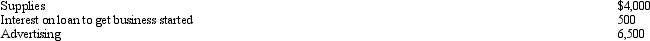

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income,deduct nothing for AGI,and claim $10,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct interest of $500 for AGI.

E) None of the above.

Correct Answer:

Verified

Q74: Tommy, an automobile mechanic employed by an

Q76: Angela,a real estate broker,had the following income

Q77: Vera is the CEO of Brunettes,a publicly

Q78: Iris,a calendar year cash basis taxpayer,owns and

Q80: Which of the following cannot be deducted

Q82: Which of the following is not relevant

Q83: Amy incurs and pays the following expenses

Q84: Because Scott is three months delinquent on

Q85: If a vacation home is determined to

Q86: For constructive ownership purposes,which of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents