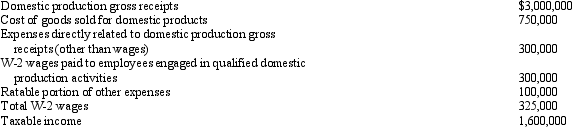

Green,Inc. ,manufactures and sells widgets.During 2010,an examination of the company records showed the following items:

Determine Green's domestic production activities deduction for 2010.

Determine Green's domestic production activities deduction for 2010.

Correct Answer:

Verified

Q78: Cream,Inc.'s taxable income for 2010 before any

Q79: If a taxpayer has an NOL in

Q80: John had adjusted gross income of $60,000.During

Q84: In 2009,Robin Corporation incurred the following expenditures

Q86: Discuss the treatment of casualty and theft

Q102: How is qualified production activities income (QPAI)

Q104: What are the three methods of handling

Q106: A taxpayer who sustains a casualty loss

Q109: Identify the factors that should be considered

Q109: Why was the domestic production activities deduction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents