Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

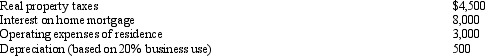

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business.Gross income from the business is $12,000,while expenses (other than home office)are $5,000.Expenses relating to the residence are as follows:

What is Rocky's net income from the repair business?

What is Rocky's net income from the repair business?

Correct Answer:

Verified

Q106: Myra's classification of those who work for

Q108: Once set for a year, when might

Q113: How are combined business/pleasure trips treated for

Q123: Christopher just purchased an automobile for $40,000

Q131: A taxpayer just changed jobs and incurred

Q133: Brian makes gifts as follows:

Q134: What originally led to the cutback adjustment?

Q136: In the current year,Bo accepted employment with

Q138: Regarding § 222 (qualified higher education deduction

Q140: A taxpayer has multiple jobs at different

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents